Picture two children on a Seesaw. One child elevated in the air feverishly jumping on his seat in an attempt to push himself back towards the ground. The other child sternly seated on his seat with his feet anchored under steal stirrups in the sand refusing to allow his seat to move up towards the sky. Can you picture it? Could you picture the balance difficulties of the child in the air as he pounces on his seat to push it down? Can you imagine the bruising of the crotch being experienced by the child who is attempting to anchor himself down? If you can, you now understand precisely the relationship of the US Fed vs. emerging markets' central banks.

If you ever wondered why the Federal Reserve Policies are failing to create the desired inflation in the United States, the answer would clearly be the trade deficit. If you then wondered why the rest of the world is struggling with food and commodity inflation, the answer would clearly be their resistance to currency appreciation.

Of course it is no secret that every country is better off as a net exporter. Collecting money instead of paying it is always the path to greater wealth. That said, the great equalizer is currency appreciation. Currency appreciation is the only way that the two children peaceably stay in balance on the seesaw. As one country purchases, or imports goods, from another it must purchase the exporting country's currency (a capital inflow) to complete the transaction. When this purchase occurs on a frequent basis the exporting country experiences currency appreciation which reduces the cost advantage it has in producing exports. With that appreciation, the population of the exporting country realizes greater purchasing power and higher standards of living for its population. The exporting country over time becomes better able to import at a more affordable rate and becomes progressively more stable as an economy due to purchasing power. Thus, the seesaw is able to balance the children according to their actual weight or on each country's production on the merits of the goods, rather than just input costs.

However, what does a net exporter do if they wish to protect their status as an "Exporter?" Well, you surely figured this one out. They manipulate their currency by making capital inflows less attractive and/or interfering in the currency exchanges. Sound familiar? Japan selling Yen for US Dollars, Brazil placing exorbitant taxes on capital inflows, China exchanging Yuan for US Dollars in a closed government controlled non-market based exchange and India raising interest rates (In India's case this certainly isn't going to work in battling currency inflation is it? But that is a topic for a different article. Higher interest rates=greater rates of return for foreign currencies).

If you ever wondered why the Federal Reserve Policies are failing to create the desired inflation in the United States, the answer would clearly be the trade deficit. If you then wondered why the rest of the world is struggling with food and commodity inflation, the answer would clearly be their resistance to currency appreciation.

Of course it is no secret that every country is better off as a net exporter. Collecting money instead of paying it is always the path to greater wealth. That said, the great equalizer is currency appreciation. Currency appreciation is the only way that the two children peaceably stay in balance on the seesaw. As one country purchases, or imports goods, from another it must purchase the exporting country's currency (a capital inflow) to complete the transaction. When this purchase occurs on a frequent basis the exporting country experiences currency appreciation which reduces the cost advantage it has in producing exports. With that appreciation, the population of the exporting country realizes greater purchasing power and higher standards of living for its population. The exporting country over time becomes better able to import at a more affordable rate and becomes progressively more stable as an economy due to purchasing power. Thus, the seesaw is able to balance the children according to their actual weight or on each country's production on the merits of the goods, rather than just input costs.

However, what does a net exporter do if they wish to protect their status as an "Exporter?" Well, you surely figured this one out. They manipulate their currency by making capital inflows less attractive and/or interfering in the currency exchanges. Sound familiar? Japan selling Yen for US Dollars, Brazil placing exorbitant taxes on capital inflows, China exchanging Yuan for US Dollars in a closed government controlled non-market based exchange and India raising interest rates (In India's case this certainly isn't going to work in battling currency inflation is it? But that is a topic for a different article. Higher interest rates=greater rates of return for foreign currencies).

What is the fallout of a country purposely holding its currency down? Items that are valued in US Dollars such as food, fuel and steel etc. get rather expensive for its population as they are being paid for their production in the currency that is being devalued by their government. Unable to provide comfortably for basic needs such populations may resort to civil unrest or similar types of behavior. Sound familiar?

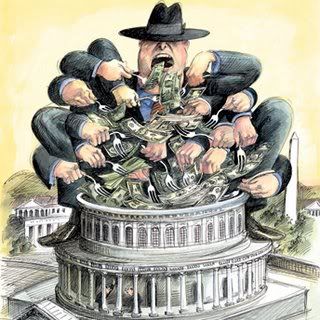

The net result is exporters that refuse to accept currency appreciation disallow the seesaw to find balance. The country in the air (the US) will stay in the air unable to create substantial jobs due to its HIGH currency valuation and inability to compete with lower employment costs. Its population will be reduced to balancing deficits, both fiscal and trade, while confined to its space on the surface area of the seat well above the ground. Unable to expand, the US may attempt to print its currency at an alarming rate- effectively jumping up and down on that seat to become more competitive and create growth. Emerging markets may insist on anchoring into the stirrups on the ground and edure the great discomfort from the seat punding against their unmentionables to maintain their position. In such a scenario the worst of results occurs if one of the parties breaks the others resistance sending one into the tree and the other face down into the dirt.

So, the next time the US Treasury Secretary states that China, "Must allow its currency to appreciate to create balance," think of him saying, "Let us down you creeps." Conversely, when you hear China respond with "It is in both of our interests for our currency to appreciate but it must be gradual,"- remember it is better to take it groin than to be hopelessly stuck in the tree.

The net result is exporters that refuse to accept currency appreciation disallow the seesaw to find balance. The country in the air (the US) will stay in the air unable to create substantial jobs due to its HIGH currency valuation and inability to compete with lower employment costs. Its population will be reduced to balancing deficits, both fiscal and trade, while confined to its space on the surface area of the seat well above the ground. Unable to expand, the US may attempt to print its currency at an alarming rate- effectively jumping up and down on that seat to become more competitive and create growth. Emerging markets may insist on anchoring into the stirrups on the ground and edure the great discomfort from the seat punding against their unmentionables to maintain their position. In such a scenario the worst of results occurs if one of the parties breaks the others resistance sending one into the tree and the other face down into the dirt.

So, the next time the US Treasury Secretary states that China, "Must allow its currency to appreciate to create balance," think of him saying, "Let us down you creeps." Conversely, when you hear China respond with "It is in both of our interests for our currency to appreciate but it must be gradual,"- remember it is better to take it groin than to be hopelessly stuck in the tree.