Many Americans are wondering if this Country could possibly create another bubble. Well, we are currently in the process, the environmental bubble.

Making sense of the proper role of America. Articles on the necessity of statesmanship in our nation today.

While some may find outrage in the public sector becoming involved in the private market place, the reality is that those aggressive municipalities enjoy greater population growth, higher standards of living for residents and enhanced tax receipts. The benefits gained from incentives, makes such municipalities even stronger in the competition to lure businesses as they have more money to flaunt. A secondary public incentive market has thereby been created where the strong municipalities become stronger and the weak become weaker. A state of nature of sorts for the public sector. Those cities unwilling to participate with public money shall be without either public money nor private business (see city of San Bernardino and there decision to allow an auto mall and a shopping mall fail).

STATES

The same principle rings true for states. A perfect example is how the State of Arizona and the State of Michigan have literally removed billions of dollars from the State of California.

The State of Arizona formed an entire economic development campaign centered around picking businesses out of the high tax and highly regulated business environment of California. Arizona accomplished this by placing advertisements and sending recruits into California to make the case that business could be so much better across the border. Further, Arizona puts their money where their mouth is by offering free land, electricity and no taxes for a limited time to come see how good business is across the border. Further, by maintaining less than one third of the environmental prohibitions of California, businesses who move receive yet another subsidy. The net result: Arizona has more money to continue its efforts, California continues its course of self destruction.

Recently, the State of Michigan has found prosperity by competing with the state who refuses to compete. By offering a large tax credit to the movie industry for filming in Michigan and providing studios abandoned manufacturing plants for production facilities at no cost, Michigan has enjoyed significant economic stimulus usually reserved to Tinsel Town. Michigan boasts of over 40 films to be shot within its state in 2009. With dwindling margins from Internet access to movies, and a reduction of box office receipts, the help is welcomed by the studios once limited to the Hollywood Hills. The net result, Michigan is making money and starting to reinvent itself, California is losing ownership of its golden goose.

NATIONS

Every nation on the planet, with the exception of the United States, has been subsidizing its fundamental industries since the beginning of time. China subsidizes oil, gasoline, timber, and its banking system to provide Chinese businesses with a leg up on the global economy. China also violently controls its currency, wage laws and environmental laws to lure business into its borders so it can reap the benefits for the whole of its citizens.

Japan has furthered its imperialistic goals through trade since the dismantling of its imperial army at the end of the second World War. The Japanese literally stock pile dollars to keep the Yen artificially weak. The Japanese also subsidize its manufacturers by funding pensions, manipulating input costs and providing subsidized loans to further lower costs of production and increase those companies profitability.

England has a nationalized banking, health care and unemployment system which takes the burden off of their companies to provide such social services as terms of employment. Germany subsidizes steel, rubber and other components for its automotive companies which were literally capitalized and created by its government in the first place. Finally, Holland controls the number of market participants from clothing to ice cream to balance the benefits of both sustainability and competition.

With the birth of the multi-national company, the global economy has created nation-less bodies without allegiance to any flag or citizenry. They shop country to country for competitive advantages without care for the destruction they leave in their wake. These companies bring prosperity, revenue and increased standard of living when they come to a country and leave gaping holes of unemployment, abandonment and civil unrest when they leave. In every sense the public partner who corrals them enjoys the spoils of their operations.

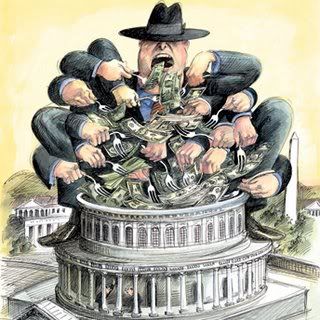

With the spending of every public dollar in Washington to bolster U.S. companies, the cry of the "capitalism for capitalism's sake" population cry with outrage. Time has passed them by. No other country on earth willingly sits idle as their businesses crumble. Especially when they compete in a market where public private partnerships have raised the stakes and lowered the costs. The cries of outdated Americans who claim government should "but out" are those who, not by their intentions, offer future American prosperity up for slaughter by foreign PPPs.

There is no other option. The US must stand as one with their business community and compete, least they be the Californias and San Bernardinos of the International scene. While markets do function well without interference, that time has long passed the human race. No foreign superpower is willing to accept the failure of its private sector for the sake of good old sportsmanship. Americans better wake up and start working together because there is no such thing as Santa Clause and there certainly isn't such thing as a private market. Whether we wish this to be different, or not, the stakes of the game are too high and the market too competitive for ingenuity and gumption alone.

Just as the United States won the revolutionary war by not standing in a straight line as proper etiquette of war demanded, other countries shall not allow their businesses to fail for the sake of decorum or idealistic rational. Commerce has changed, and with it Americans must toughen their stride, support their own and compete. Fighting with one hand behind its back, although admirable, is foolish.